The company was founded to generate profit and prosperity for investors and shareholders. To report its performance to stakeholders, the company publishes financial statements. Financial statements can confirm or not invest for investors because financial statements can provide information for investors to determine the financial condition during a specific period [1,2]. Companies must improve their performance to have good growth prospects.

The company's level of success can be known by looking at the firm value. Information about the firm value is useful for investors because it can assess how the company manages its assets. The company's high value will also offer increased prosperity for investors [3]. The stock price is fair so that it is used as a proxy for the firm value because the stock price in the capital market is generated due to investors' supply and demand relationship. The higher the stock price, the higher the firm value. According to investors, the firm value will be influenced by the high and low share prices.

Companies that exist today are institutions that have significantly contributed to society. These companies provide job opportunities for the community, contribute to state revenue through taxes, provide for community needs and other contributions. With this contribution, the company can freely move to carry out its operational activities. However, recently many companies have had problems in their relationship with the community related to environmental pollution, such as the case of hot mud, explosions in drilling wells, which resulted in air pollution [4].

Several factors that influence the firm value are earning power. Earning power is the company's ability to generate net income during the accounting period. The earning power Ratio shows how capable the company is in generating profits, both from existing sales and from total assets owned. In addition, firm value is also influenced by other factors such as liquidity. Liquidity measures how a company pays all of its liabilities using its assets. The liquidity ratio shows the smoothness of a company in meeting its short-term obligations. The indicator of liquidity used is liquidity by comparing current assets and current liabilities. The high liquidity proves that the company can cover its short-term liabilities. The financial leverage ratio is another factor that can affect firm value. Financial leverage determines how capable the company is of bearing its obligations. This ratio shows how significant the portion of debt in the company is when compared to existing capital or assets.

Align with the globalization process, public awareness of the company's impact on social and environmental conditions increases. Parties interested in the company began to pressure it to disclose its social responsibility. The research results in several developed countries prove that investors currently include the sustainability variable in the investment decision-making process [5,6]. Investors tend to invest in companies that care about social and environmental issues or companies that have high standards in social and environmental problems.

It is hoped that the company will gain the power of social law and maximize its financial strength in the long term by implementing Corporate Social Responsibility (CSR). Disclosure of information on the disclosure of social and environmental reports in the annual report is one way for companies to build, maintain and legitimize the company's contributions from an economic and political perspective. In addition, social and environmental disclosure is one way for companies to show good performance to the public and investors. With this disclosure, the company will get a good image and recognition that the company is also responsible for the environment around the company. The company will have an attractiveness in investment [5,7,8].

Corporate social responsibility is an idea that makes companies no longer faced with responsibilities based on a single bottom line, namely the firm value reflected in financial conditions only [9,10]. But the company's responsibility must be based on the triple bottom line, which is also paying attention to social and environmental issues. CSR development is related to the increasingly severe environmental damage occurring in Indonesia and the world, ranging from deforestation, air and water pollution to climate change. Companies can provide additional reports on the environment and value-added statements, especially for industries where environmental factors play an essential role.

The financial statements above require the reporting function to secure company assets and secure social and environmental welfare. Financial statements must also assess management's responsibility in managing the resources entrusted to it.

Social responsibility can be described as the availability of financial and non-financial information related to an organization's interaction with its physical and social environment. If a company wants to survive, it needs to pay attention to the 3Ps, namely profits and having to make a positive contribution to society (people) and actively participate in preserving the environment (planet). The community needs information about how the company has carried out its social activities so that people's rights to live safely and peacefully, employee welfare and food safety can be fulfilled [11].

On the other hand, companies must provide information about their social activities. So far, the development of conventional accounting (mainstream accounting) has been widely criticized for not being able to accommodate the interests of the wider community, resulting in a new accounting concept known as Social Responsibility Accounting (SRA). Social responsibility means that companies have responsibility for actions that affect consumers, society and the environment [12,13,14]. So far, accounting products are intended as management accountability to shareholders and now the paradigm has been expanded to become accountable to all stakeholders. In addition, social and environmental disclosure is one way for companies to show good performance to the public and investors. With this disclosure, the company will get a good image and recognition that the company is also responsible for the environment around the company so that the company will have an attraction in investment. A good image and recognition of the company's performance are considerations for investors in making investment decisions [15,16]. With these considerations, investors tend to invest in companies that have a good reputation because investors believe that a good reputation can be obtained if the company already has good economic performance. The better the firm performance, the more investors will invest in the company and impact the firm value.

Various studies related to corporate social responsibility disclosure and its impact on corporate value show various results. This consistency indicates that research related to the effect of company characteristics on CSR disclosure is essential. CSR is related to the company's survival because the implementation of social and environmental exposures is closely related to the company's relationship with stakeholders and the community and the environment at large. Based on this, the problem in this research is that liquidity, financial leverage and earning power affect the extent of CSR disclosure and firm value and does CSR mediate this relationship?

Literature Review

Signaling theory explains the actions taken by management to provide clues to investors about how management views the company's prospects. Signaling theory illustrates information asymmetry between the company and external parties (investors). Information asymmetry means that one party has more information than the other. The company is a party that has a lot of information related to the company's prospects in the future. Meanwhile, investors have little information about the company, so they tend to give low prices to protect themselves. To anticipate this, the company will try to increase the value by providing signals to investors to minimize information asymmetry.

The company's earning power, liquidity and effectiveness are a signal for investors to invest their capital [17,18,2]. Some opinions state that a high ratio value is considered a good signal because it describes the company in a favorable condition. If the reported ratio value is low, it is considered a wrong signal because it represents the company in a bad situation. Companies with good prospects try to avoid selling shares. However, it is different from companies that have inadequate opportunities trying to sell their shares.

This theory assumes that management provides information to investors about the decisions taken regarding the firm value. If the value of earning power, liquidity and effectiveness reported by the company changes or not, it provides separate information for investors.

Corporate Social Responsibility is a mechanism for an organization to voluntarily integrate environmental and social concerns into its operations and interactions with stakeholders beyond its legal responsibilities [19,8]. Corporate social responsibility is disclosed in a report called Sustainability reporting. Sustainability reporting is reporting on economic, environmental and social policies, the influence and performance of organizations and their products in the context of sustainable development.

CSR disclosure aims to communicate social realities for economic, social and political decision-making. Disclosure of social responsibility is also a response to the information needs of interest groups such as trade unions, environmental activists and other groups. Companies that are successful in implementing Corporate Social Responsibility have three core values that are deeply rooted in the company, namely: (1) economic resilience, (2) environmental responsibility and (3) economic accountability [20].

Social and environmental disclosure is a mechanism for an organization to socially and environmentally integrate environmental and social concerns into its operations and interactions with stakeholders, which goes beyond its legal responsibilities. The practice of social and environmental disclosure can be seen as a company's effort to send a message to stakeholders about the actions taken by the company for social and environmental interests. The benefits of social and environmental disclosure are to: (1) Aligning firm values with social values, (2) Avoid pressure from certain groups, (3) Improve company image and reputation, (4) Demonstrate managerial principles, (5) Demonstrate corporate social responsibility and (6) Social and environmental disclosure is a managerial tool to avoid social and environmental conflicts.

The company's main goal is to increase its value. The company will always try to achieve and maintain firm value by performing optimally. One of them is that the company must be able to align its economic interests with its environmental and social objectives. The greater the company's attention to the community, the greater the potential for its growth. Thus, if the company wants the firm value to increase, the company must be able to improve its environmental performance. Based on the theory of legitimacy, recognition from the community is very important for the company's sustainability in the future. A well-created company image will undoubtedly be more attractive to investors [20,21].

Liquidity is a condition that shows the company's ability to meet short-term funds. As indicated by a high liquidity ratio, corporate health is expected to be associated with broader disclosure. It is based on the fact that financially sound companies are likely to disclose more information than companies with low liquidity. On the other hand, if the market views liquidity as a measure of performance, companies with low liquidity ratios need to disclose more detailed information to explain weak performance compared to companies with high liquidity ratios.

A high level of liquidity will indicate the company's strong financial condition [17,22,23]. A company that can meet its financial obligations on time means that the company is liquid and has more current assets than current liabilities. Thus, companies with high liquidity will tend to make more disclosures to convince their stakeholders [7,18,24].

The researcher chose the liquidity variable because the liquidity ratio affected the extent of social and environmental disclosure. If the company's condition has a good liquidity ratio, it shows that it has a good financial structure. If the institution knows this condition, then the company's performance is not threatened. The company delivers the validity of its performance. Based on the explanation, the following hypothesis can be formulated:

Hypothesis 1: Liquidity affects the extent of CSR disclosure

Liquidity is a ratio to determine how the company pays all its short-term liabilities that will mature using its assets. Disclosure of information regarding the liquidity ratio is one of the company's efforts in sending signals related to the company's good reputation in the eyes of investors to make investors believe in investing in the company [25,26,22]. The high liquidity ratio will be considered a positive signal for investors because the company can pay off all its short-term liabilities. Investors will be interested in investing, resulting in high demand for shares and impacting high share prices and firm value.

Hypothesis 2: Liquidity affects firm value

Companies with high-interest debt will limit management's ability to invest more in social disclosure programs [24,27]. The high-interest rate on debt also encourages creditors to play an active role in supervising the management, where debt signals the company's financial condition to fulfill its obligations. Additional information is needed to dispel the doubts of bondholders regarding the fulfillment of their rights as creditors.

The higher the level of the leverage ratio, the more likely the company will violate the credit agreement so that the company will seek to report higher current earnings. Managers must reduce costs for reported earnings to be high, including disclosing social information. Social and environmental disclosure costs are limited, so social information disclosure is low or limited. Thus, leverage is negatively related to social and environmental exposures. Based on the explanation above, the following hypothesis can be formulated:

Hypothesis 3: Financial leverage affects the extent of CSR disclosure

The use of debt in the company can be used to measure the firm value because high debt causes the firm value to decrease. This condition occurs because investors consider that high debt causes a considerable risk to the return on their investment. After all, debt will create a fixed burden in the form of interest that must be paid by the company so that profits decrease and shareholder capital also decreases.

High debt encourages creditors to monitor managers to optimize firm value [13,22,28]. This monitoring allows debt holders to evaluate the company's eligibility to receive loans and comply with debt covenants. Companies that use large amounts of debt to fund companies are close to the covenants of creditors. The amount of debt increases the risk of default. This results in a decrease in the firm value because it is not attractive for investors to invest. Based on the explanation above, the hypothesis can be formulated:

Hypothesis 4: Financial leverage has a positive effect on firm value

Earning power is a ratio that measures the company's ability to generate profits (earning power) at the level of sales, assets and capital. Earning power measures the extent to which the company generates net income at a certain level of sales. A high-profit margin indicates the company's ability to create high profits at a certain level of sales or high costs for a certain level of sales. In general, a low ratio can indicate management inefficiency.

Companies with good financial performance capabilities will be identical with efforts to make more extensive disclosures. The extent of exposure caused by the company [29,18,30] is an effort to gain support and seek the sympathy of its stakeholders. Companies with high performance will increase the firm value in forming an image that is very influential in gaining the trust of stakeholders. Good company performance can be reflected through the level of earning power obtained from time to time.

The earning power variable will encourage managers to provide more detailed information. They want to convince investors of the company's earning power and compensation to management. So, the higher the company's earning power, the higher the index of social and environmental disclosure completeness. Earning power is obtained from the distribution of earnings after tax with total assets. Based on the explanation above, the following hypothesis can be formulated:

Hypothesis 5: Earning power affects the extent of CSR disclosure

Earning power is defined as a measure of the company's level of effectiveness in generating profits. The higher the earning power, it means that the company is getting better, more productive and more efficient in reducing costs so that it is able to obtain high profits and investors' confidence to invest.

Companies can provide signals to investors through the company's financial statements. With this report, investors can determine how much earning power the company generates. A high level of earning power illustrates that a company is in good condition and prospects.

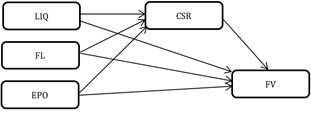

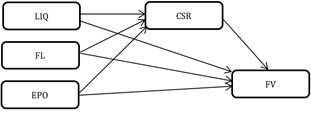

Figure 1: Framework of relationship between variables

With:

CSR: disclosure of corporate social responsibility

LIQ: Liquidity ratio

FL: Financial leverage ratio

EPO: Earning power

FV: Firm Value

Investors will perceive it as a good signal when the company has high earning power. Investors will respond to this signal by buying company shares, resulting in high share prices and firm value [13,31,32]:

Hypothesis 6: Earning power affects firm value

The company needs the commitment to perform performance and CSR consistently to encourage the firm value to grow sustainably [5,33,34]. The provision of CSR in annual reports and sustainability reports represents the company's environmental performance. The disclosure provides information on environmental protection practices that can reduce costs associated with violating government environmental regulations, potential litigation and costs associated with pollution.

CSR affects firm value. The public, as potential investors, tends to be interested in information on social and environmental activities reported in reports published by companies. With good performance and CSR, investors will give a positive response in the form of interest in buying company shares and this will make the demand for company shares increase and stock price fluctuations increase:

Hypothesis 7: CSR has a positive effect on firm value

The conceptual framework of this research which is sourced from theory and previous research is arranged in a relationship pattern as shown in Figure 1.