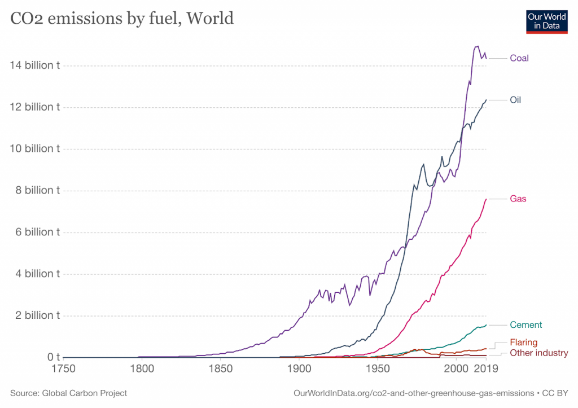

As societal awareness regarding environmental conservation grows, there arises an increasing concern regarding the sustainability practices of businesses. Key environmental issues such as global warming, climate change, resource scarcity and clean water access have garnered significant attention. Among these, climate change emerges as a paramount concern due to its severe and enduring global impacts, primarily stemming from the combustion of fossil fuels.

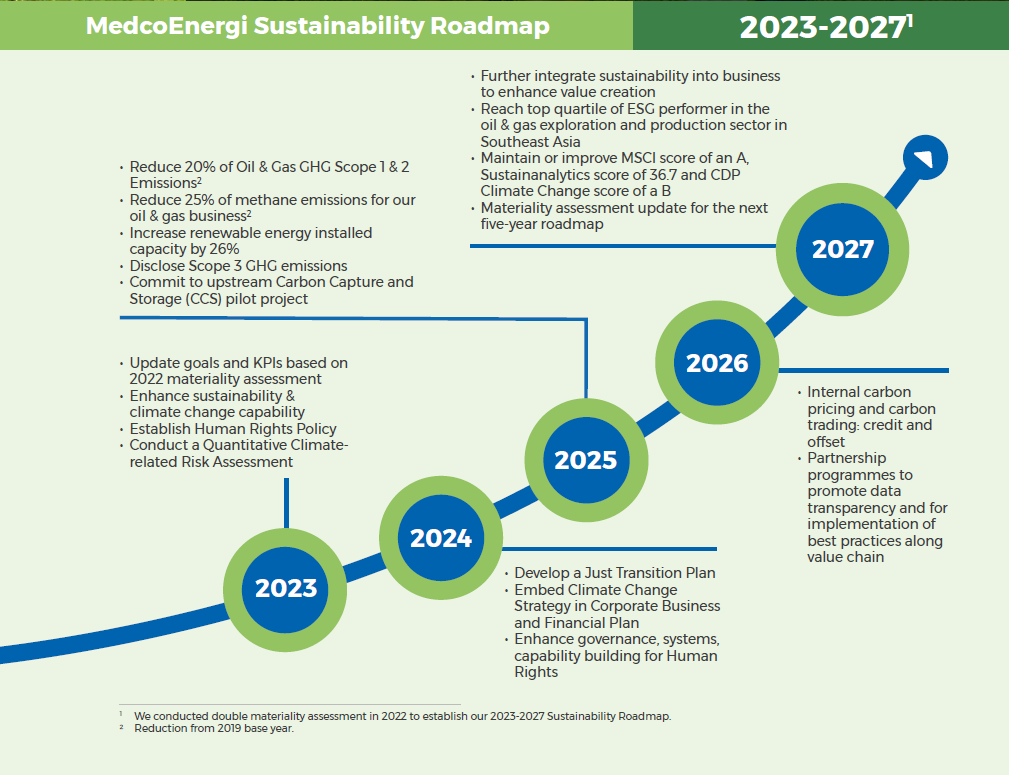

The accompanying Figure 1 illustrates the distribution of worldwide CO2 emissions by fuel type, emphasizing the substantial contribution of oil to the total emissions. Annually, an estimated 36 billion tonnes of CO2 are released from the combustion of fossil fuels, with oil accounting for 34%, equating to 12 billion tonnes. This process leads to the formation of CO2, acting as a greenhouse gas, thereby exacerbating the Earth's temperature and precipitating various adverse effects.

This realization prompts business leaders to reassess their operational strategies, necessitating a consideration not only of financial gains but also of the social and environmental repercussions of their endeavors. Consequently, numerous International Oil Companies (IOCs) have adopted an Environment, Social and Governance (ESG) framework, redirecting their focus towards sustainable practices and renewable energy sources.

Since the inception of the Paris Agreement in 2015 to the proposition of Sustainable Development Goals (SDGs) outlined in Agenda 2030 by the United Nations, the oil and gas (O&G) sector has recognized its pivotal role in addressing environmental and social challenges inherent in its production and consumption processes. These include issues such as geopolitical conflicts, CO2 emissions, methane emissions, local disruptions and water contamination.

Acknowledged for its capital-intensive nature, the oil and gas industry typically relies on equity and loans to meet its financial obligations. Historically, many financial institutions have offered preferential interest rates to this sector. However, a growing awareness of ESG considerations has led several banks to discontinue this practice, signaling a shift towards promoting sustainable financing practices within the industry.

Figure 1: World CO2 emissions by fuel type (Smoot, 2023)

Company Profile

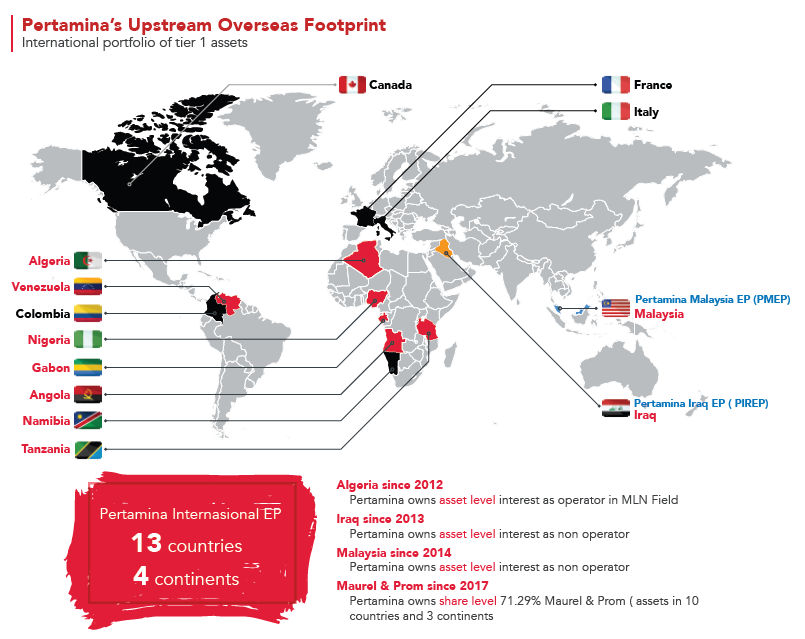

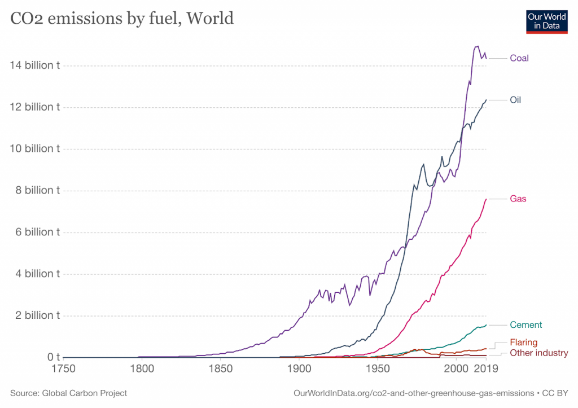

Pertamina Internasional Eksplorasi dan Produksi (PIEP) was established based on the need for management of international assets focused on managing foreign oil & gas assets of PT Pertamina (Persero). For this reason, it is deemed necessary to establish a subsidiary with international coverage as a holder of overseas assets whose activities can be adjusted to the characteristics of the assets owned.

On November 18, 2013, PIEP was established in Jakarta as a company that runs businesses in the fields of oil, natural gas and other energy with international working areas. Until December 2023, PIEP had 11 (eleven) working areas spread across 3 (three) main regions, namely Africa, Asia and the Middle East, as well as several exploration assets in other regions (Figure 2).

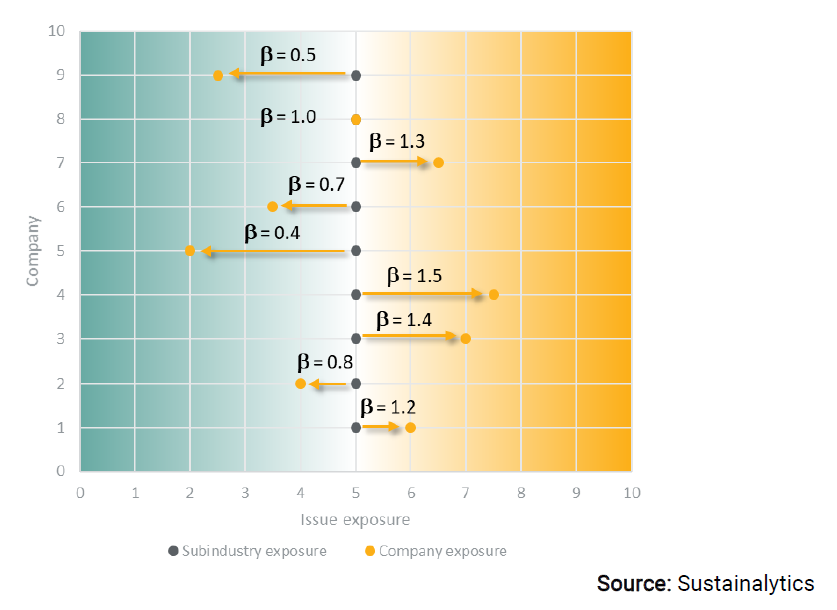

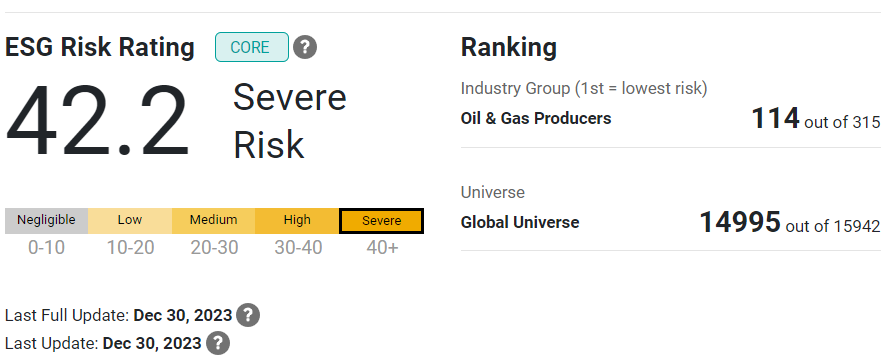

In 2017, PT Pertamina Internasional Eksplorasi dan Produksi (PIEP) entered into a syndicated loan agreement with two Indonesian national banks and seven international banks. In an effort to fortify their financial standing, PIEP's management opted to extend the grace period on their debt. However, subsequent to the submission of the proposal to the bank syndicate in 2021, three international banks withdrew from the agreement citing their policy of exclusively lending to companies possessing a commendable ESG Risk Rating. Consequently, the interest rates on the loan escalated from LIBOR plus 1.5 percentage points to SOFR plus 2 percentage points. This escalation in interest rates is anticipated to amplify interest expenses and diminish net income. Compounding the situation, the insistence of many financial institutions on an ESG risk classification poses a significant threat to PIEP. This predicament presents a formidable challenge to PIEP's management, particularly given their lack of formal evaluation and implementation of an ESG framework. It is imperative for PIEP to promptly adopt an ESG framework to secure an optimal ESG Risk Rating, thereby enhancing its appeal to potential investors and financial institutions.

Figure 2 PIEP’s Overseas Footprint

Source: PIEP Annual Report 2021

LITERATURE REVIEW

Initial perceptions of ESG activities held that they constituted an agency problem that resulted in a decline in wealth [1]. Friedman [2] elucidates this notion when he asserts that the corporate manager, acting as the agent, ought to steer the enterprise in a manner consistent with the shareholders' objective of maximizing wealth. In other words, corporations ought to refrain from allocating their resources towards endeavors such as social and environmental good governance, as doing so would result in a reduction of shareholder value.

Brown, Helland and Smith [3] and Kruger [4] find that managers engaging in corporate philanthropy benefit themselves at the expense of shareholders. Similarly, agency costs are incurred when managers invest in social activities to promote their personal reputation [5] and can lose focus on core managerial responsibilities [6]. Overall, based on the agency view, ESG practices are generally not in the interest of shareholders.

Agency Theory

Agency theory, initially formulated by Jensen and Meckling [6], elucidates the dynamics within corporate governance structures, particularly concerning conflicts of interest between principals and agents. The theory delineates that principals delegate decision-making authority to agents, typically managers, whose interests may not always align with those of the principals, leading to potential agency problems.

Fundamental to agency theory is the recognition that agents, motivated by self-interest, may not consistently act in the best interests of principals. This may result in behaviors such as opportunism, where agents exploit opportunities for personal gain at the expense of principals or shirking, where agents fail to exert optimal effort.

To manage the principal-agent relationship effectively, agency theory advocates for mechanisms such as contracts, performance-based incentives, monitoring and governance mechanisms. These mechanisms aim to align the interests of principals and agents, thereby mitigating agency conflicts.

However, implementing these mechanisms entails costs and potential conflicts of interest among stakeholders. Thus, a persistent challenge in managing the principal-agent relationship is striking a balance between minimizing costs and risks while advancing the interests of both principals and agents.

Agency theory has found widespread application across various disciplines, including economics, finance, management and corporate governance, providing a valuable framework for comprehending and managing the intricate relationship between principals and agents within organizations.

Moreover, agency theory suggests that agents, such as managers, may prioritize corporate social performance and environmental concerns over financial considerations, particularly since these activities no longer directly impact a company's revenue. This is consistent with the foundational principles of agency theory, as agents may engage in philanthropic endeavors to enhance their public image and reputation.

Drawing on Jensen and Meckling agency theory, involvement in Environmental, Social and Governance (ESG) activities introduces new agency predicaments between managers and shareholders. Shareholders may perceive ESG spending as contrary to their best interests, potentially diminishing overall profits. Agency issues concerning ESG activities can manifest in various ways, including resource misallocation, opportunity costs and strategic manipulation to mask poor financial performance.

The literature also suggests that companies with ample liquidity and no financial constraints may be particularly susceptible to agency issues concerning ESG activities. High liquidity, signaled by substantial capital expenditure and free cash flows, can exacerbate agency costs, as managers may exploit these resources for personal advantages.

Environmental, Social and Governance (ESG)

The term ESG finds application in management [7-8], financial [9-10] and qualitative [11] contexts, leading to challenges in crafting a precise definition. It is commonly described as a set of pertinent activities that an organization should incorporate into its strategy and execute [12]. According to the ESG concept, responsible business is characterized by the adoption of appropriate environmental practices, socially responsible employee conduct and the implementation of sound corporate governance practices [13].

The environmental (E) dimension assesses a company's influence on the natural ecosystem, including factors such as climate change, biodiversity and emissions like greenhouse gasses. It considers the efficiency of natural resource utilization in the production process, encompassing energy, water and materials, as well as the company's impact on pollution, waste generation and deforestation [12, 14]. Establishing environmental management systems, which involve investments in research, development and innovation, including product enhancements and improvements to the environmental supply chain, is essential for companies in this dimension [15]. Compliance with legal and regulatory requirements related to environmental protection is a crucial aspect within the ESG framework [16].

The social (S) dimension encompasses the company's interactions with its employees, customers and society at large. Its objectives revolve around community development, public health considerations, ethical conduct, respect for human rights, product responsibility (quality assurance), responsible marketing practices, safeguarding data privacy and initiatives focused on personnel, including support for diversity and inclusion, career development, training and enhancements to working conditions and health and safety measures [16]. Activities within the social dimension aim to foster employee loyalty, customer and community satisfaction (building a positive image as a good neighbor) and contribute to societal well-being as a whole, often through charitable endeavors and support for employee volunteerism [12,14,16].

The corporate governance dimension (G) encompasses the existing management systems, incorporating a corporate social responsibility strategy, ESG reporting and transparency. It includes measures to safeguard shareholder rights, such as protection against corporate takeovers and emphasizes a well-functioning board of directors, featuring experienced, diverse and independent members. Motivated by a well-designed executive compensation policy, the governance dimension also involves audit procedures, compliance protocols and ethical principles, such as a code of conduct and the avoidance of illegal practices like fraud and bribery [12,14,15].

ESG governance relies on an integrated set of processes, structures and systems to assist the board of directors in guiding the company [17]. Assumptions within corporate governance influence management quality [18], consequently impacting capital allocation efficiency and the ability to sustain and grow capital over the long term [19].

In any organization, managers play a pivotal role as decision-makers. From an ESG perspective, their responsibility involves identifying and reconciling the diverse and often conflicting interests of the company's key stakeholders [20-22]. These interests must be integrated into the corporate culture, management strategy, business model, actions taken and reporting [23]. Managers operate under institutional pressures from social and cultural environments, including legislators, regulators, customers, local communities and environmental organizations, which influence their strategic decisions [24-25].

ESG Risk Rating

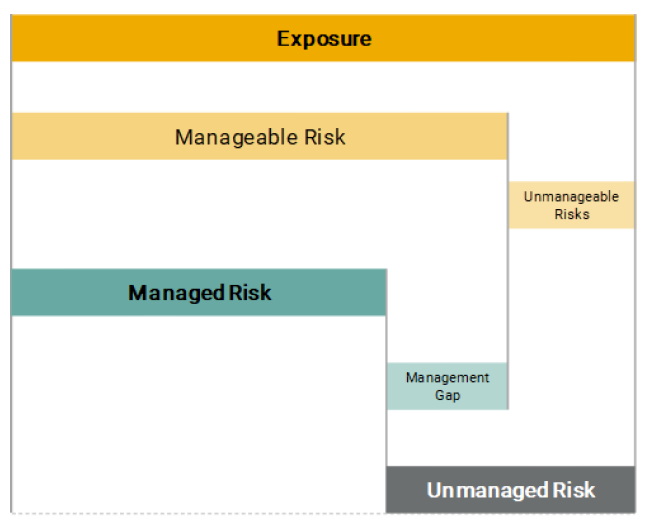

ESG risk rating involves the quantitative or qualitative evaluation of a company's performance in environmental, social and governance (ESG) dimensions, as well as the associated risks. This assessment tool is utilized by investors, rating agencies and research providers to gauge companies' sustainability and responsible business practices.

The ESG Risk Ratings specifically analyze the degree to which a company's economic stability is susceptible to ESG (Environmental, Social and Governance) factors, essentially measuring the level of unaddressed ESG risks faced by the company.

Investors can leverage ESG risk ratings to incorporate ESG factors into their analysis and decision-making processes. These ratings offer insights into a company's ESG profile and potential risks, enabling investors to align their investments with sustainability goals, ethical values and long-term financial objectives.

It's essential to acknowledge that ESG risk ratings come with their own set of limitations. These challenges include issues related to data availability and quality, a lack of standardization and comparability across industries and the possibility of greenwashing or misrepresentation of ESG performance. Despite these hurdles, ESG risk ratings play a pivotal role in fostering sustainable investment practices and motivating companies to enhance their ESG performance and disclosure.

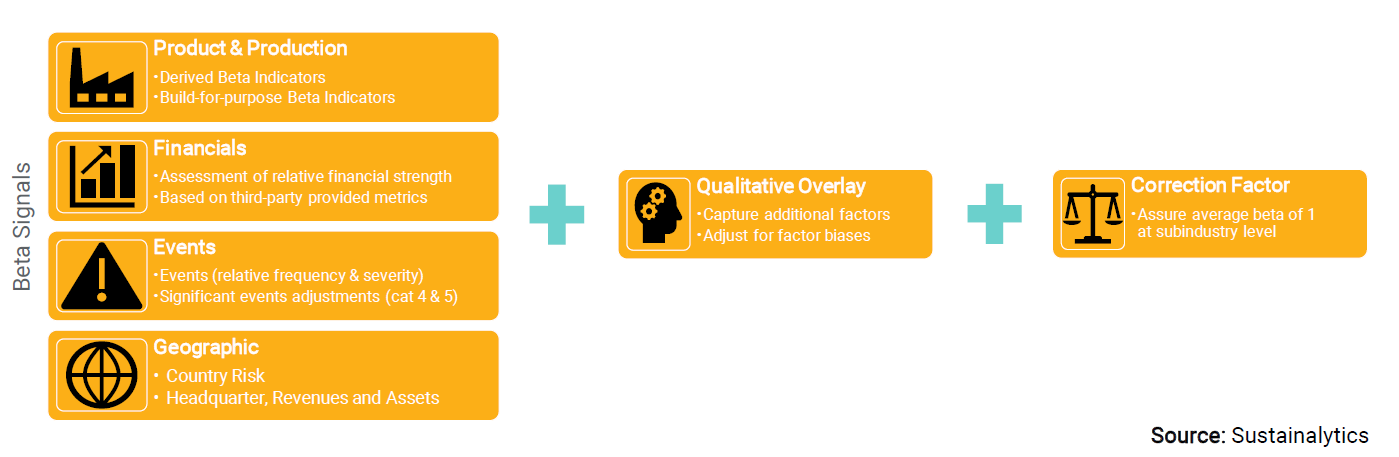

The methodologies for ESG risk ratings can differ among various rating agencies and research providers. These entities might employ proprietary models, distinct data sources and specific criteria to evaluate ESG risks and assign scores or ratings to companies. Such ratings serve as valuable tools for investors, aiding them in making well-informed decisions regarding capital allocation, guided by considerations of ESG performance and risk exposure. There are 8 (eight) global known ESG Risk Rating provider which are MSCI, RepRisk, Sustainalytics, KLD (MSCI Stats), Asset4 (Revinitiv), Vigeo-Eiris (Moody’s), RobecoSAM (S&P Global) and Bloomberg (Proprietary scores)

Some rating companies mainly use publicly available data to determine ESG scores and create these without consulting the specific company. Such as Bloomberg’s proprietary ESG scoring, launched in late 2020. The Author chose to use Sustainalytics methodology due to Indonesia Exchange having launched IDX ESG Leaders that use Sustainalytics as its official methodology. The author believes that utilizing the same ESG methodology as the listed companies provides a suitable benchmark.

Based on the Sustainalytics methodology for sub industry oil & gas Exploration, there are 11 (eleven) material issues that need to be addressed by oil & gas companies:

Environment Aspects

Emission, Effluents and Waste

Carbon Products and Services

Carbon Own Operations

Resource Use

Land Use and Biodiversity

Social Aspects

Governance Aspects

Bribery and Corruption

Corporate Governance

Business Ethics

ESG Risk Rating by Sustainalytics is divided into 5 (five) category which are discussed below.

Negligible

This category is the best version of a company that can manage their ESG Risk Exposure. The quantitative number for this category is from 0 (zero) to 10 (ten).

Low

For a company that has a result of quantitative number 10 (ten) to twenty can be categorized as low.

Medium

Quantitative numbers of 20 (twenty) to 30 (thirty) are categorized as medium risk. Pertamina (Persero) in 2021 has a value of 28,1 and is categorized as a medium risk oil & gas company.

High

From 30 (thirty) to 40 (forty) is categorized as high risk. Pertamina Hulu Energi in 2022 has value 31,2 and is recognized as a high-risk oil & gas company.

Severe

40 (forty) and above is categorized as severe risk. Lots of oil & gas companies are categorized as high-risk companies such as Exxonmobil with a value of 41.7, Petrochina with value of 54.4 and so forth.